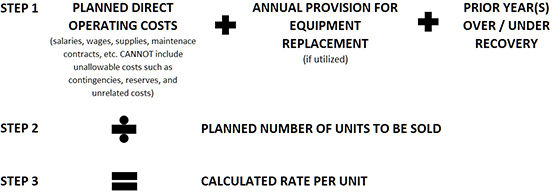

Income & Recharge rates are the estimated costs of providing service items divided by the estimated number of service units to be provided. Income & Recharge rates are computed using estimated costs and the number of service units to be provided for a specified fiscal year. Proposed rates must be based on actual consumption of the good or service being provided, and fully cover, but not exceed, costs.

How to Develop Rate

- Identify the goods/services to be offered.

- Evaluate customer base. Who will be your customers?

- Determine annual estimated costs for providing each good or service. Exclude unallowable costs.

- Determine the measurable service unit for each goods or service.

- Determine the annual output, or expected level of activity, for each good or service. All usage should be tracked and factored into the rate calculation.

- Determine the amount of any applicable subsidy. Where Income & Recharge Center operations are proposed to be subsidized, the funding source should be specified in the Income & Recharge proposal and the subsidy fund is linked to the recharge account. See Subsidy for more information.

- Determine the rate per unit.

Basic Rate Calculation

Key Cost Accounting Principles for Rates

- Rates must be based on actual/estimated costs.

- The numerator in calculating rates (expenses) cannot include unallowable costs.

- The denominator in calculating rates (measurement of usage) must reflect all users, both internal and external, regardless of price charged.

- The denominator must be a measure or reasonable proxy for actual usage.

- Over time, an Income & Recharge Center should break even (excluding reserve balances and NUD).

- All campus users – regardless of department or funding source – must be charged the same rate for identical goods and services.

- Non-UC users should pay the actual cost recovery rate plus a Non-University Differential (NUD) markup of at least 55.5% The minimum NUD markup rate will be reviewed annually and is subject to change. See External Users for more information.

Service Units

An Income & Recharge Center provides one or more goods or services to its customers. Each distinct good or service provided must have a unit of good or service, which becomes the basis for charging customers. This unit of good or service is referred to as a "service unit".

The ideal service unit:

- is identifiable and measurable;

- is able to accurately reflect the resources necessary to produce it, especially the costs;

- accurately reflects the extent of benefit received by the user.

Some examples of service units are: per hour of machine time, per hour of labor time, and per test.

In order to estimate usage, use prior year(s) numbers as a starting point and adjust for expected changes. In the start-up phase, it is often difficult to estimate expected usage. Income & Recharge Centers without sufficient usage history can use available units as a starting point and adjust for downtime and other intervening factors.

Costs of Providing Services

The following general requirements apply to all service items and all costs of the recharge activity:

- All costs of providing the service items (as identified below) must be included in the recharge plan

- Costs that are included in the computation of rates should be consistently included each year if the costs are incurred for the same purpose in like circumstances

- All costs must conform to generally accepted costing principles. Costs must be:

- Allowable. The expense must be permitted and be in accordance with University and other applicable guidelines and policies.

- Allocable. The cost must be assigned to one or more service lines in reasonable and realistic proportion to the benefit provided.

- Reasonable and Necessary. The cost must be necessary for providing the goods and/or services and reflect the action that a prudent person would have taken.

- Consistently treated. Costs incurred for the same purpose, in like circumstances, must be treated consistently as either direct or indirect costs.

- The Income & Recharge Center must actually "pay" the costs of providing service items (i.e., incurred costs must actually be charged to the activity's appropriate chartstring).

Allowable Costs

Federal policy requires that costs associated with providing goods and services are allowable and recovered through direct charges to users based on actual usage at a pre-established per unit price.

Costs associated with the direct administration of a recharge activity are allowable expenses on a recharge plan and should be included. Such costs include salaries and wages, benefits, supplies, services, depreciation, etc., associated with the accounting, billing, purchasing, personnel, supervision, and other general support functions of the recharge activity.

It is common for recharge activities to have a surplus or deficit at the end of any specific fiscal year because the actual revenues received and costs incurred during that year differ from the budgeted amounts used to calculate the recharge rate. However, over a period of time (normally 2-3 years) it is expected that recharge activities will operate close to break-even. An exception is allowed for a working capital and equipment reserves.

Although, surpluses and deficits are common in any one fiscal year. The goal is to have a recharge activity that operates close to break-even. Every effort should be made to ensure that year-end surpluses or deficits do not exceed three months of the recharging unit's activity.

During the rate review process, the projected surplus or deficit from the prior year, in excess of any allowed working capital surplus or provision for equipment reserve, must be included as a reduction from or an addition to expenses in the rate computation.

- Actual (or projected) surplus or deficit must be included in the following year's rate calculation.

- A year-end surplus will reduce the following year's cost pool and, therefore, the rate

- A year-end deficit will increase the following year's cost pool and, therefore, the rate

- Over/under allocation methods for I&R Centers with more than one line of service:

- Allocate using prior year net income/loss

- Find the net profit/loss for each line of service by determining the total revenue and the total associated expenditure.

- Using the total net profit/loss, calculate a percent of total net profit/loss and use those percentages to allocate the over/under recovery to the various lines of service.

- Best practice: Tracking the actual balance for each line of service by matching actual revenue with actual expenses using cost centers and/or project codes.

- Allocate using percent of total prior year expenditures

- Determine total expenditures for each service line.

- Based on total expenditures, find the percent of the grand total expenditures and use those percentages to allocate the over/under recovery to various lines of service.

- Allocate using prior year net income/loss

- Surpluses from one recharge fund may not be used to offset deficits from another.

- Deficit balances may be covered using a departmental discretionary fund. Please work with the Office of Budget & Planning to process the appropriate transactions.

- Surpluses or other monies may not be transferred out of the recharge activity without prior approval from the Office of Budget & Planning.

In exceptional cases where inclusion of a surplus or deficit in the subsequent year would cause a severe fluctuation in the rates from one year to the next, approval may be granted to amortize the surplus or deficit over a longer period to lessen the impact on the following year’s rates.

As part of the annual recharge rate review, Income & Recharge Centers that carry an unacceptable surplus/deficit are required to establish a plan to rectify the situation and bring the center within the acceptable levels of tolerance.

Large Deficit - If a center has a large deficit, where the year-end general ledger deficit is defined as more than three month’s operating expense, it must develop a deficit reduction plan explaining the situation and corrective action that will be taken to clear the deficit. The plan should eliminate the deficit in as short a time as possible, not to exceed 3 years. If the deficit is not reduced to acceptable limits in that timeframe, the department and control point may need to cover the deficit.

Large Surplus - If a center has a large surplus, where the year-end general ledger surplus is defined as more than three month’s operating expense, the unit cannot raise its rates. If a center has a large surplus, it must develop a plan to amortize the surplus in as short a time as possible, not to exceed 3 years. Rates must be downwardly adjusted or else refunds may need to be issued.

Non-inventorial equipment may be purchased on the recharge fund. However, if the cost is significant and it benefits more than one year of service, then the cost may be amortized.

Repair and replacement costs for “like” items that do not add a significant amount of value or extend the useful life may also be purchased on the recharge fund.

Maintenance and repair costs keep machinery and other property in an efficient operating condition. Costs for maintenance agreements should be counted as maintenance. Replacement of a broken part with a comparable new part is considered as the purchase of an item of supply or equipment. To be allowable as a repair cost charged to federal awards, the repair may not appreciably prolong the repaired item's intended life nor add to its permanent value.

The position being advertised must be necessary for the recharge operations. Recruitment advertising should be appropriately allocated to all accounts/activities benefited, including departmental research/teaching.

Salaries and wages of personnel associated with providing the service items, maintenance of equipment used in the recharge activity, or directly administering the recharge activity should be included. Salaries and wages are to be funded using Sub 2. Associated fringe benefit costs should also be included. Note that when employees are identified as part of an Income & Recharge Center their payroll distribution should reflect that assignment and their payroll expenses will need to be funded from the Income & Recharge Center account/fund. Salaries and wages are to be funded using Sub 2. Associated fringe benefit costs should also be included.

When the rate calculation is based on a per hour labor service unit the rate per hour should only reflect the employee’s billable time. Hourly rates should be calculated based on total costs divided by annual billable hours in order to recover the full cost of providing service. Billable hours are the total time available, less non-billable time such as time for vacation, sick leave, holiday, other forms of leave, breaks, equipment downtime, machine repairs, education/certification and meetings. If the rate was calculated based on the total annual hours (both billable and non-billable), the rate would be too low and not recover the full cost.

See B&FS General Accounting website for more information, including when an inventory account must be established.

Unallowable Costs

Typical departmental Facilities and Administrative costs that are included in UCSB’s negotiated federal indirect cost recovery rates should not be included in recharge budgets and rates, in order to prevent double-charging of these costs to federal agencies. In addition, costs not allowable to charge to federal funds should not be charged to recharge budgets or included in recharge rates.

Please refer to 2 CFR 200 for further information.

- Administrative or support staff whose duties do not support processes specific to the center are unallowable. Also, incidental administrative costs related to the activity are unallowable. Incidental administrative effort is when an individual contributes less than 5% of his/her annual effort in support of an activity.

- Advertising, marketing, and public relations (this includes travel for the purpose of these activities)

- Alumni activities

- Bad debts, fines or penalties

- Banking and credit card fees

- Commencement or convocation costs

- Cost of items funded by the Federal Government

- Donations and contributions

- Entertainment (alcohol, event tickets, flowers, gifts, etc.)

- Equipment

- Equipment (>$5,000) Direct purchases of inventorial equipment are prohibited on the recharge operating fund. However, a Provision for Equipment Reserve shall be included as a cost in the rate development and charged to the recharge operation fund, unless the inventorial equipment is funded by the Federal government or is identified as cost sharing to a federal project.

See Equipment Reserve for more information. - Capital expenditures for equipment which materially increase their value or useful life

- Equipment (including consumer electronics) or services that are able to transmit or route data or include video surveillance equipment and produced or managed by the following companies and their subsidiaries: Huawei Technologies Company, ZTE Corporation Hytera Communications Corporation, Hangzhou Hikvision Digital Technology Company, and Dahua Technology Company

- Equipment (>$5,000) Direct purchases of inventorial equipment are prohibited on the recharge operating fund. However, a Provision for Equipment Reserve shall be included as a cost in the rate development and charged to the recharge operation fund, unless the inventorial equipment is funded by the Federal government or is identified as cost sharing to a federal project.

- ETS Support Assessment

- Exceptional charges that did not occur through the normal course of business; e.g. additional costs incurred to recover “uncollected” income due to the department not billing users accordingly

- Fundraising and investment costs

- General, Automobile and Employment Liability (GAEL)

- Leasehold improvements

- Legal proceeding costs

- Lobbying costs

- Memberships/subscriptions in civic, community or social organizations

- Non-cash awards/gifts

- Short-Term Investment Pool (STIP) expense

- Space

- Capitalized space renovations or improvements, including renovation costs or significant alterations or structural changes which increase the usefulness, enhance the efficiency, or prolong the life of the property*

- Operations and maintenance of space that is eligible for state OMP support, including building depreciation and utilities

- An activity should not include charges for its use of centrally supported space (i.e., building depreciation cost component, utilities) nor the University’s general and administrative costs as these are funded from other sources. However, if the unit incurs additional specialized services that are not funded from other University resources, these can be included in the rate and costs of the unit.

- Travel unless directly related to services necessary to support the recharge activity

- Training costs to create new goods/services are not allowed in the recharge account, because to do so would be charging users for goods/services not yet rendered

- UCOP Assessment

- UCRP Supplemental Interest Assessment

Generally Unallowable Costs

Costs that are generally unallowable, unless directly related to, exclusively benefitting and required to provide the recharge services. These costs require approval in order to be considered allowable.

Business meeting expenses for morale or entertainment purposes are unallowable.

Requires additional justification. Honorariums for services provided by non-UCSB employees must be necessary for the services or commodity being provided, and must be consistently applied to all eligible individuals with supporting documentation justifying the amounts being paid.

- Interest associated with the purchase of capital equipment is allowable when it satisfies the following criteria:

- Interest must be paid to outside third party.

- The equipment must have been acquired on May 8, 1996 or after.

- For acquisitions prior to May 8, 1996, the purchase price of capitalized equipment must be $10,000 or greater.

- A letter must be on file with the University’s cognizant agency (DHHS) requesting approval to charge these interest costs to the Income & Recharge Center. If the agency subsequently denies this request, all interest charged to the recharge unit must be transferred to other allowable funding sources.

Parking passes should never be used by employees, vendors, or recharge operation customers. They may be included if they are for participants or like individuals whom are necessary for the good/service being provided.

Pass-Through Activities

Pass-through activities are activities where goods or services are purchased by a University department and charged to another University department at invoice cost, without markup for recovery of other costs. Pass-through activities, by definition, will always break-even.

It is never permissible to “pass-through” University costs to external users at invoice cost. A non-university differential (NUD) must always be applied to “pass-through” (i.e., pure invoice based) transactions with external users.

To establish a pass-through activity, departments must include a statement in the Income & Recharge proposal describing why the activity is needed and how they will manage it. Department must inform the Office of Budget & Planning if they decide in the future that the operation will recover any other expenses.

Pass-through activities should follow the recharge procedures of excluding federally unallowable costs, charging users based on measurable usage, charging all users, and breaking even.

Standard pass-through activities are to be administered in a separate fund linked to the recharge account. See Chart of Accounts for more information.

Departments should charge for pass-through costs within 45 days of when the goods or services were provided. Departments should use the recharge mechanism to charge internal users. Income received from external users must be credited to the revenue account associated with the pass-through fund (actual cost recovery portion) and the NUD fund (NUD portion).

Records documenting actual products distributed to account strings should be maintained. These records are subject to audit.

A periodic review of these activities is required and will be fulfilled either through the review of the associated Income & Recharge Center or submission of a financial statement.